AI in Insurance Underwriting: How Algorithms Are Changing Risk Assessment

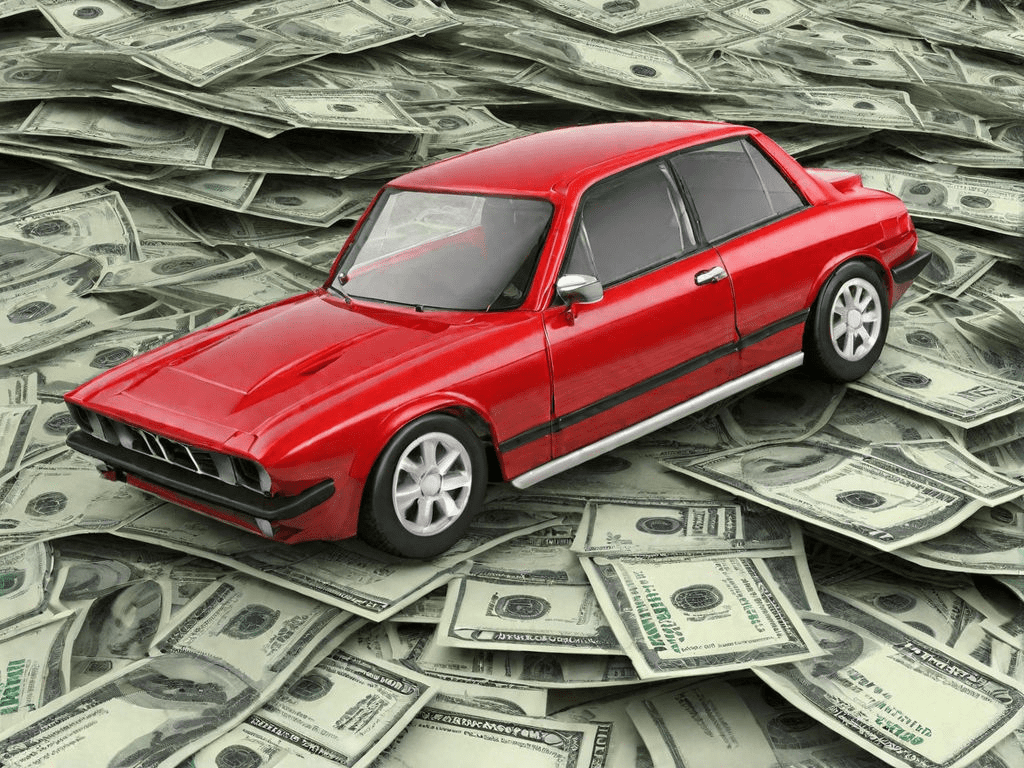

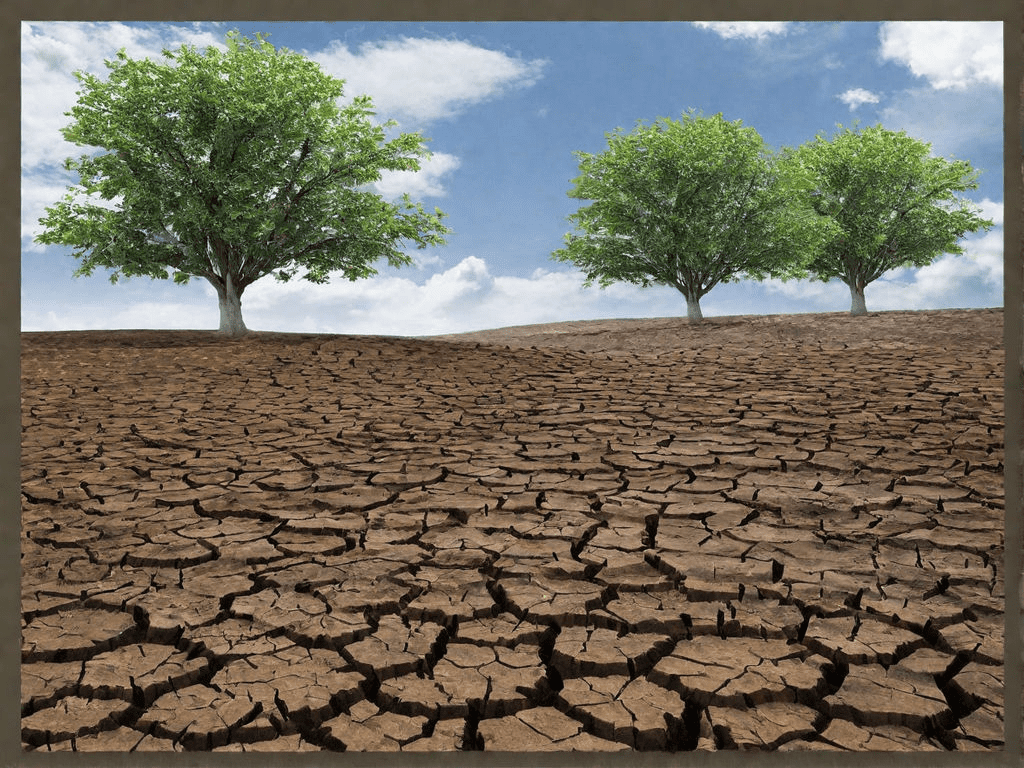

Your neighbor’s auto insurance premium drops 30% while yours stays flat—despite identical cars and clean driving records. Her insurer knows she brakes gently and avoids night driving; yours only knows she’s 28 years old. A small business gets cyber insurance in 15 minutes while another waits six weeks for rejection. One building secures coverage after … Read more